E Invoicing for Small Businesses What You Need to Know in 2025

As the Indian tax landscape continues to evolve, e-invoicing has emerged as a game-changer for businesses of all sizes. Initially introduced for large enterprises, e-invoicing has gradually become mandatory for smaller businesses too. By 2025, e-invoicing is no longer just an option — it’s a critical compliance requirement for many MSMEs. But what exactly is e-invoicing, who needs to comply, and how can you make it easy?

At Karosauda, we’ve simplified e-invoicing for thousands of small businesses. In this guide, we’ll walk you through everything you need to know about e-invoicing in 2025 — requirements, benefits, and how to implement it without stress.

What is E-Invoicing?

E-invoicing is the system where B2B invoices are electronically authenticated by the Goods and Services Tax Network (GSTN). Once generated, the invoice is assigned a unique Invoice Reference Number (IRN) and QR code, and then sent back to the seller.

The purpose is to standardize invoices, prevent tax evasion, and simplify GST return filing.

Who Needs to Comply with E-Invoicing in 2025?

As of April 2025, the e-invoicing threshold has been reduced significantly. Now, all businesses with an annual aggregate turnover of Rs. 5 crore and above (in any financial year from 2017-18 onward) are required to generate e-invoices.

This includes:

- Manufacturers

- Traders

- Service providers

- E-commerce sellers

Exempted entities include:

- SEZ units

- Banks and NBFCs

- Insurance companies

- Government departments

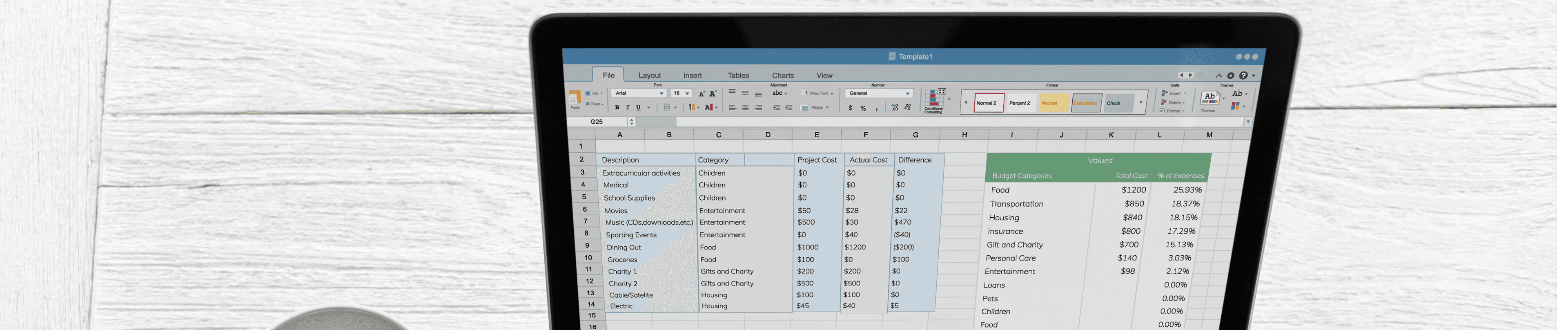

Benefits of E-Invoicing for MSMEs

Though it might seem like an added compliance burden, e-invoicing actually offers several advantages:

- Faster payments: Standardized invoices mean fewer disputes and quicker clearances.

- Error reduction: Automation reduces manual entry mistakes.

- Improved cash flow: Real-time invoice tracking improves collection cycles.

- Seamless ITC claim: Auto-populated GSTR-1 data helps buyers claim input tax credit easily.

- Reduced audits: Transparent invoicing reduces the chances of scrutiny or notice.

How E-Invoicing Works – A Step-by-Step Process

- Invoice Generation: You create an invoice in your billing software, following the e-invoicing schema.

- IRN Generation: The invoice is uploaded to the Invoice Registration Portal (IRP).

- IRP Validation: The IRP checks for errors and validates the invoice.

- IRN & QR Code Issuance: A unique IRN and digitally signed QR code are generated.

- Invoice Delivery: The authenticated invoice is returned and shared with the buyer.

- GST Portal Integration: The invoice is auto-populated in your GSTR-1.

Karosauda Tip: Our e-invoicing solution integrates directly with IRPs and GSTN to automate the entire process.

Mandatory Fields in an E-Invoice To ensure your invoice is compliant, include:

- Supplier and buyer GSTIN

- Invoice number and date

- HSN codes

- Taxable value, tax rate, and amounts (CGST, SGST, IGST)

- Item-wise details

- IRN and QR code

Common Challenges Faced by Small Businesses

- Lack of technical infrastructure: Many MSMEs still use manual billing systems.

- Compliance confusion: Understanding schema and API documentation can be tricky.

- Fear of penalties: Non-compliance can lead to rejection of invoices and tax credit issues.

- Cost concerns: Investing in e-invoicing software may seem expensive.

Karosauda Solution: We provide an affordable, plug-and-play e-invoicing tool tailored for MSMEs, with no tech expertise needed.

Best Practices for E-Invoicing Compliance

- Use Approved Software: Ensure your billing system is compatible with IRP standards.

- Train Your Team: Staff should understand how e-invoicing works and why it matters.

- Validate Before Uploading: Check all mandatory fields are filled correctly.

- Keep Backup Records: Store signed invoices securely for future audits.

- Integrate with GST Returns: Let your software sync with GSTR-1 automatically.

What Happens If You Don’t Comply?

If you fall under the mandate but fail to generate e-invoices:

- Your invoice is considered invalid for GST purposes

- Your buyer cannot claim ITC

- You may face penalties under Section 122 of the CGST Act

- Risk of audit and scrutiny increases

What’s New in E-Invoicing for 2025?

- Lower Threshold: Rs. 5 crore turnover and above are now covered

- Integration with E-Way Bill: One-time data entry creates both documents

- Real-time Invoice Sharing: Faster invoice tracking for buyers

- Improved Analytics: Businesses get dashboard views for IRN tracking, rejections, and reconciliation

Why Karosauda is the Right Choice for E-Invoicing

- Easy onboarding

- GST-compliant billing and invoicing

- Real-time IRN generation

- Integrated with GSTR filing

- Budget-friendly plans for MSMEs

- Reliable support team for assistance

We believe in empowering small businesses with tools that simplify compliance and boost efficiency.

Conclusion

E-invoicing is not just about meeting a legal requirement — it’s about future-proofing your business. In 2025, as more MSMEs fall under the e-invoicing umbrella, being prepared can give you a serious competitive edge. With tools like Karosauda, you don’t need to be a tax expert to stay compliant.

Ready to simplify e-invoicing for your business? Get started with Karosauda today and stay ahead of the compliance curve!

Blogs

Why Karosauda is the Best Accounting Software for Indian MSMEs

Why Karosauda is the Best Accounting Software for Indian MSMEs

How Karosauda Helps You File GST On Time Every Time

Filing GST returns is a routine but critical task for every registered business in India.

Managing Your Business Cash Flow with Smart Invoicing Tools

Cash flow is the heartbeat of every business — especially for small and medium enterprises (SMEs) in India.

Frequently Asked Questions

Contact us

Any Question?

Feel free to reach out

We promise we won’t spam you with unwanted calls