Inventory and Expense Management Tips for Indian Traders and Retailers

For Indian traders and retailers, managing inventory and expenses efficiently can be the key to higher profits, fewer losses, and long-term sustainability. In a competitive and fast-moving market, poor inventory control or unchecked spending can quickly eat into margins. The good news? With the right systems and strategies, you can streamline your operations and boost profitability.

At Karosauda, we help small businesses gain real-time control over their stock and spending. In this comprehensive guide, we’ll share practical inventory and expense management tips specifically designed for Indian traders and retailers.

1. Categorize and Organize Inventory Properly

Disorganized stock leads to miscounts, pilferage, and missed sales opportunities.

Tips:

- Group items by category, brand, or season

- Assign SKU codes for tracking

- Label shelves clearly for faster access

Karosauda Tip: Use our barcode and SKU support to simplify your stock categorization and billing.

2. Use Real-Time Inventory Management Tools

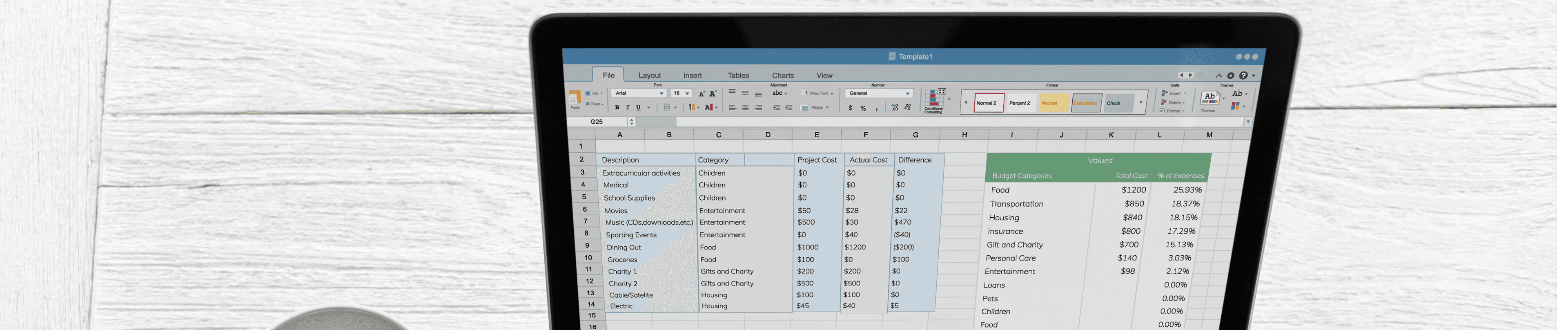

Manual stock registers or Excel sheets are prone to error. Switch to a digital system that updates inventory live as you sell or restock.

Benefits:

- Accurate stock levels

- Faster billing

- Low-stock alerts

Karosauda Insight: Every bill generated through our system updates your stock in real time.

3. Set Minimum and Maximum Stock Levels

Avoid overstocking (which ties up capital) and understocking (which causes lost sales).

Action Plan:

- Identify fast-moving vs slow-moving products

- Set reorder points based on sales trends

- Maintain buffer stock for high-demand seasons

4. Track Expiry Dates and Batch Numbers

For FMCG, pharma, or food retail, expired items mean loss and reputational damage.

Tips:

- Store batch-wise stock data

- Use FIFO (First In First Out) method

- Clear short-expiry stock via offers or discounts

Karosauda Tip: Enable expiry alerts and batch-level tracking in your inventory settings.

5. Conduct Regular Physical Stock Audits

Mismatch between physical and digital stock leads to confusion and accounting errors.

Tips:

- Do monthly stock counts

- Investigate variances promptly

- Train staff on proper inward/outward recording

6. Record Every Expense — Big or Small

Often, petty expenses like delivery charges, maintenance, or packaging go unrecorded. Over time, these add up.

Best Practice:

- Record every rupee spent

- Categorize expenses (transport, salary, rent, etc.)

- Review monthly reports

Karosauda Tip: Use our expense entry module to record, tag, and analyze all your business spend.

7. Monitor Supplier and Purchase Costs

Buying at the right price is as important as selling at a profit.

Action Steps:

- Track rate changes from vendors

- Compare prices across suppliers

- Analyze purchase trends

Karosauda Insight: Our reports help you spot vendor overcharging and negotiate better deals.

8. Manage Credit Sales and Payments Carefully

Allowing too much credit or losing track of receivables can cause cash crunch.

Best Practices:

- Set credit limits per customer

- Track due dates

- Send payment reminders

Karosauda Advantage: Our system shows who owes you what and when — and sends auto-reminders.

9. Analyze Profit Margins Item-Wise

You might be selling more, but are you earning enough per item?

What to Do:

- Compare selling price vs purchase + overheads

- Identify low-margin products

- Promote high-margin items actively

10. Digitize Your Billing and Reporting

Manual bills mean human errors and lost records. Digital billing:

- Links with inventory

- Creates instant reports

- Simplifies GST return filing

Karosauda Benefit: All your billing, stock, and expense data is stored safely in the cloud — accessible anytime.

11. Plan Purchases Based on Sales Trends

Don’t buy what you think will sell — buy what has sold well.

Action Steps:

- Review monthly sales reports

- Identify peak and low-demand periods

- Buy accordingly and avoid dead stock

12. Train Staff on Proper Inventory Practices

Even the best system fails if your staff isn’t using it right.

Tips:

- Train employees to enter bills, inward stock, and returns properly

- Use role-based access to limit mistakes

- Monitor staff activity via logs

13. Automate Where Possible

Automation saves time and improves accuracy.

- Auto-update inventory with billing

- Auto-generate reorder alerts

- Auto-calculate profit reports

Karosauda Insight: Our platform offers smart automation for inventory, GST, expenses, and ledgers.

14. Review Monthly Reports to Stay on Track

Don’t wait till year-end to check performance.

Must-Check Reports:

- Item-wise sales

- Expense breakdown

- Stock movement

- Profit/loss statement

Karosauda Tip: Get all key reports on one screen — updated daily.

15. Use Data for Smarter Decisions

With real-time insights, you can:

- Offer discounts on slow-moving stock

- Plan staff requirements based on footfall

- Shift focus to high-profit product lines

Why Choose Karosauda for Inventory and Expense Management?

- Real-time inventory with barcode/SKU support

- Expense tracking with category-wise reports

- Low stock and expiry alerts

- Vendor and credit tracking

- Smart dashboards and mobile access

Built for Indian traders and retailers who want simplicity, speed, and savings.

Conclusion

Managing inventory and expenses doesn’t have to be complex or time-consuming. With a little discipline and the right digital tools, Indian traders and retailers can reduce waste, increase profits, and stay ahead of the competition.

At Karosauda, we make it easy for you to take control — from purchase to sale, from expense to profit.

Ready to upgrade your stock and expense game? Try Karosauda today and run your business smarter!

Blogs

Why Karosauda is the Best Accounting Software for Indian MSMEs

Why Karosauda is the Best Accounting Software for Indian MSMEs

How Karosauda Helps You File GST On Time Every Time

Filing GST returns is a routine but critical task for every registered business in India.

Managing Your Business Cash Flow with Smart Invoicing Tools

Cash flow is the heartbeat of every business — especially for small and medium enterprises (SMEs) in India.

Frequently Asked Questions

Contact us

Any Question?

Feel free to reach out

We promise we won’t spam you with unwanted calls