Manual Billing vs Cloud Based Accounting Software What is Better for MSMEs

In 2025, MSMEs in India face an important decision — stick with traditional manual billing methods or switch to cloud-based accounting software. While manual billing might seem simpler and more cost-effective at first glance, the reality is that digital tools offer long-term benefits that far outweigh the initial learning curve.

At Karosauda, we’ve seen thousands of MSMEs make the transition — and the impact is immediate. This blog explores the key differences between manual and cloud-based accounting, the pros and cons of each, and why the future is digital.

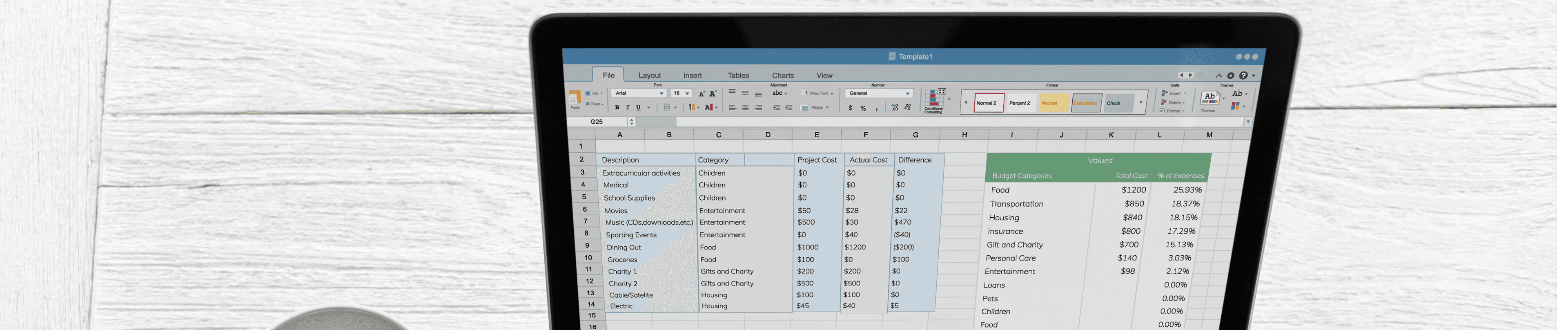

What is Manual Billing? Manual billing involves creating invoices and tracking expenses using pen-paper, spreadsheets like Excel, or basic software without real-time syncing or automation. It usually includes:

- Handwritten invoices

- Excel-based ledgers

- Manual tax calculations

- Physical filing and storage

What is Cloud-Based Accounting Software? Cloud accounting platforms like Karosauda provide online tools that manage billing, GST, inventory, and ledgers in real time. Features include:

- Automated invoice generation

- GST integration and return filing

- Real-time ledger and cash flow tracking

- Cloud backups and multi-user access

- Mobile and desktop compatibility

1. Accuracy and Error Prevention

Manual Billing: Prone to errors, especially with tax calculations, totaling amounts, and duplicate entries. These mistakes lead to GST mismatches and compliance penalties.

Cloud Software: Auto-calculates taxes, validates data fields, and prevents duplicates. This ensures accuracy and reduces compliance risk.

Karosauda Tip: Our platform prevents common GST mistakes like HSN errors or tax rate mismatches.

2. Time Efficiency

Manual Billing: Preparing and recording each invoice takes significant time, especially during tax filing season. Reconciliation is a nightmare.

Cloud Software: Invoices are generated in seconds, and transactions are auto-recorded in your ledger. GST returns are pre-filled and ready.

Result: You save hours every week — time you can spend growing your business.

3. GST Compliance

Manual Billing: Requires manually tracking tax amounts, filing returns via portal uploads, and keeping up with changes in GST law.

Cloud Software: Auto-updates with latest GST rules, generates compliant invoices, and files returns with a few clicks.

Karosauda Advantage: Built-in e-invoicing, GSTR-1/3B filing, and ITC reconciliation at your fingertips.

4. Real-Time Financial Visibility

Manual Billing: Business owners often don’t know their cash flow, tax liabilities, or profitability until the month or year ends.

Cloud Software: Dashboards show live updates on sales, purchases, taxes, and balance sheets.

Karosauda Tip: Daily summaries and alerts keep you in control without needing a CA.

5. Cost Comparison

Manual Billing: Lower upfront cost but higher long-term expenses due to errors, compliance penalties, delayed payments, and lack of financial insights.

Cloud Software: Affordable monthly plans with long-term savings on manpower, errors, and late filing fees.

Karosauda Note: MSMEs using our software often recover the cost within a month through time saved and ITC claimed.

6. Scalability

Manual Billing: Becomes increasingly difficult as business grows. More customers, suppliers, and tax requirements = more paperwork.

Cloud Software: Grows with your business. Add users, automate workflows, and manage multi-location operations easily.

7. Security and Backup

Manual Billing: Paper records can be lost, and Excel files are vulnerable to corruption or accidental deletion.

Cloud Software: Automatic cloud backup, role-based access control, and data encryption ensure your business data is safe.

Karosauda Advantage: Your data is backed up daily and stored securely on Indian servers.

8. Accessibility and Mobility

Manual Billing: Access is limited to physical files or a single device.

Cloud Software: Use any device — phone, tablet, or laptop — from anywhere in the world.

Result: MSMEs can operate remotely, even when the owner is traveling or working from home.

9. Collaboration with Accountants

Manual Billing: Sharing data involves scanning, emailing, or transporting physical files — time-consuming and error-prone.

Cloud Software: CAs can log in directly, check ledgers, file returns, or troubleshoot issues in real time.

Karosauda Tip: Share real-time access with your CA and reduce the back-and-forth during audits.

10. Long-Term Business Insights

Manual Billing: No easy way to analyze past performance or generate custom reports.

Cloud Software: Provides insights on customer trends, supplier performance, seasonal spikes, and tax trends.

Karosauda Insight: Our analytics tools show you where your business is heading — and how to get there faster.

Final Verdict: What’s Better for MSMEs?

While manual billing might feel familiar, it’s not built for the dynamic needs of growing businesses. Cloud-based accounting software is faster, safer, and more efficient. It saves time, ensures compliance, and provides data that helps you grow confidently.

In a digital-first economy, choosing manual billing could mean falling behind — while cloud tools like Karosauda put you ahead of the curve.

Conclusion

Digital transformation isn’t a luxury anymore — it’s a necessity. With Karosauda, MSMEs get the best of both worlds: simplicity and power. Whether you're transitioning from manual billing or upgrading your existing tools, our platform is designed to support your journey every step of the way.

Ready to ditch manual billing and grow your business smarter? Start with Karosauda today!

Blogs

Why Karosauda is the Best Accounting Software for Indian MSMEs

Why Karosauda is the Best Accounting Software for Indian MSMEs

How Karosauda Helps You File GST On Time Every Time

Filing GST returns is a routine but critical task for every registered business in India.

Managing Your Business Cash Flow with Smart Invoicing Tools

Cash flow is the heartbeat of every business — especially for small and medium enterprises (SMEs) in India.

Frequently Asked Questions

Contact us

Any Question?

Feel free to reach out

We promise we won’t spam you with unwanted calls